However, other factors may also be influencing inflationary behavior. "It is important to monitor the increases in the average value of the dollar, which can eventually be passed on to the prices of goods. Additionally, a rise in fuel prices is expected this month," Mella notes.

One of the most significant variables would be the increase in electricity rates. "The most notable factor in terms of magnitude is the third scheduled increase in electricity bills for this month," the economist points out.

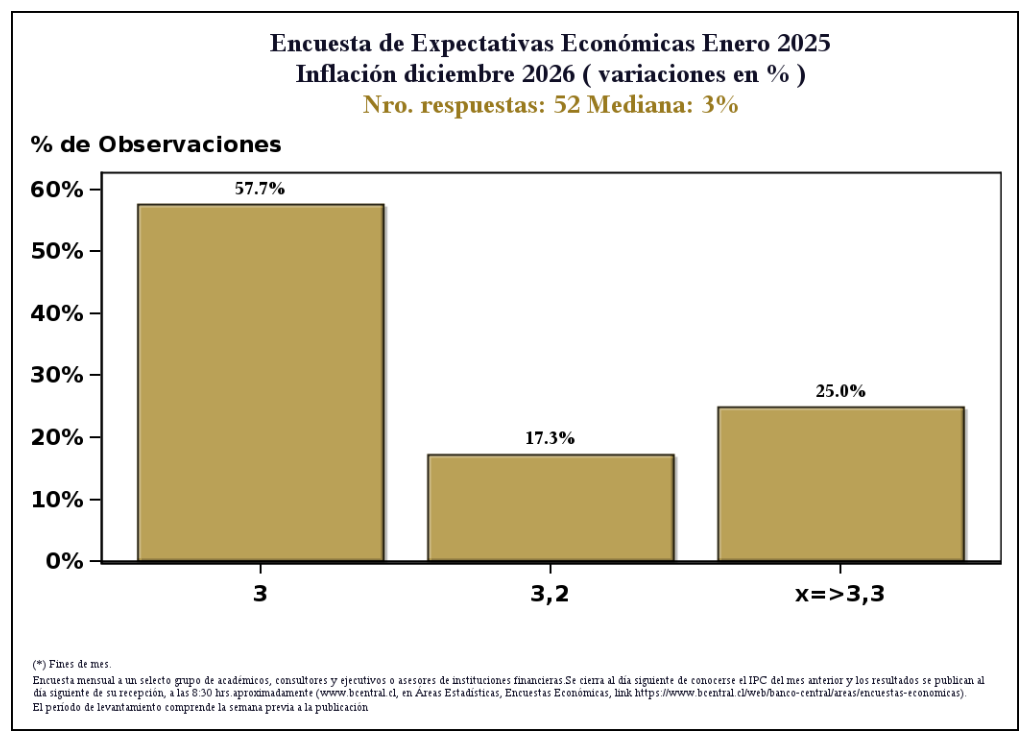

This persistent and "sticky" inflation could make the Chilean Central Bank's (BCCh) job more challenging, delaying the expected cuts to the monetary policy rate (TPM). Regarding interest rate projections, respondents anticipate that the BCCh will keep the TPM at 5.00% during the January and March meetings, with a potential decrease to 4.75% within a 12-month horizon (January 2026).

Source: